Whether it is car companies that have released autonomous driving models equipped with LiDAR, or lidar manufacturers and some comprehensive technology manufacturers actively promote the mass production process, it is clear that the door to large-scale commercial applications of LiDAR has been slowly opened.

The most important driving factor for lidar to really use vector production is still cost. If LiDAR always maintains a high price, it will be impossible to talk about mass production or commercialization.

Many years ago, Waymo made the lidar for about $7,000. Although it cut 90% of the cost compared to the LiDAR used in Google's unmanned vehicles, for mass production, such a high cost is still impossible for car companies. Bearable.

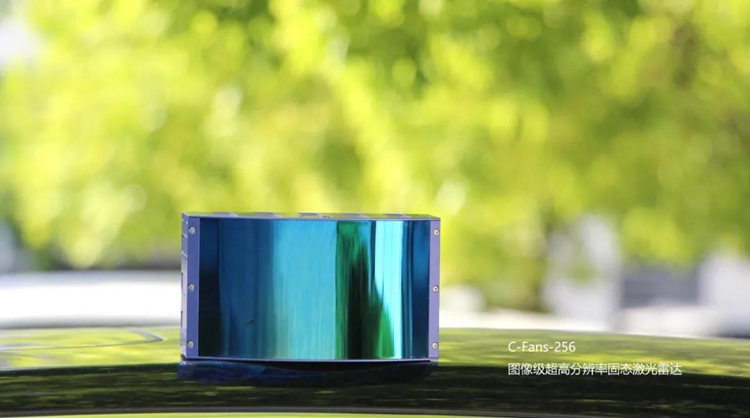

Nowadays, the auto-standard solid-state lidar C-Fans-256, which is self-developed by the industry's veteran manufacturer, is quoted as low as customers are asking for surprises. Cost may no longer be a problem.

Today, I will lead everyone together to explore why the price of lidar has remained high in the past, and how it has succeeded in continuously reducing costs in recent years.

Why was lidar expensive in the past

Why did LiDAR, which was born in the 1960s, officially go to mass production until today, more than half a century later? In the final analysis, it is a cost issue.

Cost constraints make it difficult for lidar manufacturers to reach commercial applications. The reason behind it is that we need to start with the composition of lidar equipment.

From the perspective of the working principle of lidar, it is mainly divided into four parts:

Laser emission part

The excitation source periodically drives the laser to emit laser pulses, and the laser modulator controls the direction and number of lines of the emitted laser through the beam controller, and finally emits the laser to the target object through the emission optical system.

Laser receiving system

Through the receiving optical system, the photodetector receives the laser light reflected by the target object and generates a receiving signal.

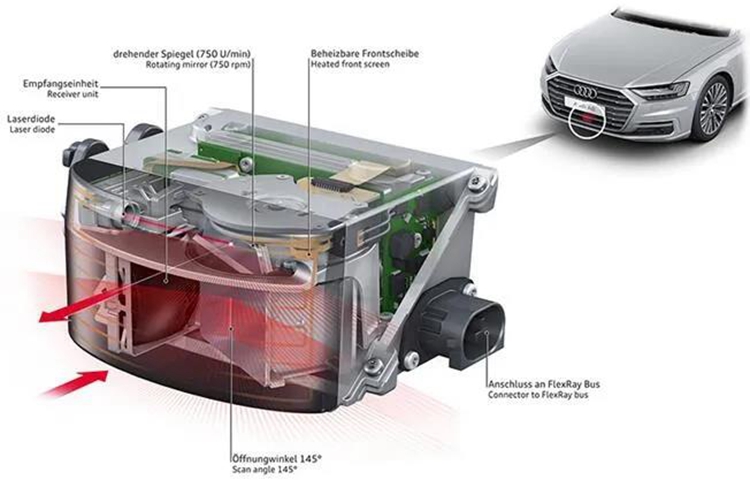

Scanning system

Rotate at a stable speed to scan the plane and generate real-time plan information.

Information Processing System

The received signal undergoes amplification processing and digital-to-analog conversion, and is calculated by the information processing module to obtain the target surface shape, physical properties and other characteristics, and finally establish the object model.

Each part of LiDAR products contains a large number of precision components. The complex structure of LiDAR itself and the price of core components have been the most fundamental reason for the high price of LiDAR, especially mechanical LiDAR, for a long time in the past.

In addition to the precision optoelectronic components, the mechanical LiDAR needs to integrate a mechanical rotating structure, which is more expensive

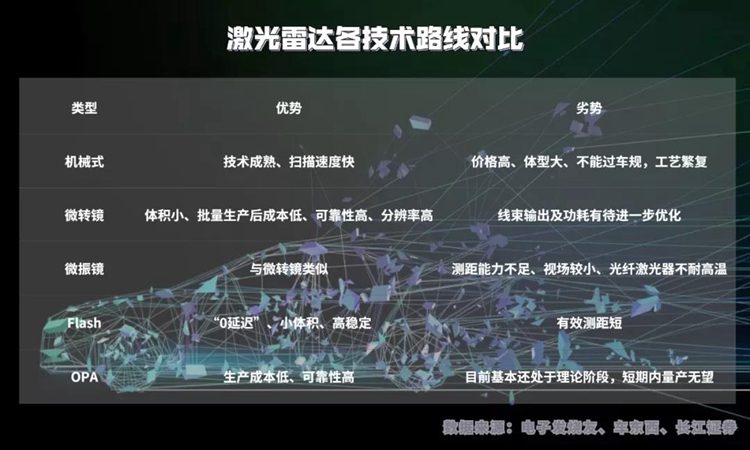

The huge number of originals and complex product structure make the choice of each component technology different will have different effects on the performance of the entire LiDAR, leading to the diversification of the LiDAR technology system.

In the R&D process of LiDAR manufacturers, it is difficult to find a technical system solution that is highly in line with product expectations and market positioning. It often needs to continuously explore, try and modify the R&D direction, so that the R&D cost of LiDAR products remains high.

Outside of the perspective of the product itself, before the high-end autonomous driving industry grew up, the market demand for navigational lidar was not high, and it was mainly concentrated on various functional unmanned vehicles. Therefore, the output of lidar has always been maintained at A very low level.

The lack of an environment for setting up production lines has caused most lidar manufacturers to adopt the "high-tech small workshop" mode of production that is difficult to effectively control costs, which objectively further pushes up the cost level of LiDAR products.

Put down the cost of lidar

Under the joint promotion of many factors, the cost of lidar has gradually "dropped" in recent years, and has shown a trend of continuous and steady decline.

As the saying goes, you need to be hard on your own. The primary reason for the drop in the cost of lidar is the same as the fundamental factor that used to be expensive, from the product itself.

Although the recognized "perfect lidar form" has not yet been born, the vast majority of navigation products on the market have chosen solid-state routes with obvious advantages.

For example, Surestar, relying on its years of exploration and heritage of lidar, launched a micro-rotating mirror architecture in a "independent way", and took the lead in the industry to miniaturize and solidify the laser transmitting and receiving modules and signal processing modules of lidars, allowing large Vehicle-gauge lidar with field of view, long range, high resolution, and low cost becomes possible.

The transformation from mechanical to solid-state not only brings more stable performance to LIDAR products, but also simplifies the internal structure of the product, making the "cost black hole" phenomenon in the scanning components and other components of mechanical radars a history.

At the same time, the dispute over the LiDAR technology route has gradually become clearer, enabling manufacturers to "less detours" in the R&D process, thereby promoting the continuous reduction of the sunk cost of LiDAR product R&D.

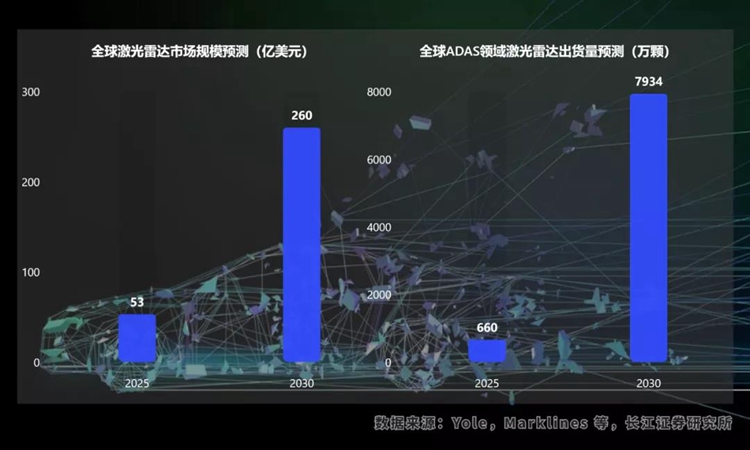

From the perspective of the market environment, the high volume of L3 autonomous vehicles and Robotaxi have provided a solid boost to the rapid growth of the LiDAR market.

According to the data of the Changjiang Securities Research Report, in 2030, the global navigation lidar market will reach 26 billion U.S. dollars, and the shipment volume will exceed 76 million units. Mass production will undoubtedly have a significant scale effect, effectively sharing the entire chain of product production costs including R&D, manufacturing, and transportation.

Specific to the domestic market, market demand continues to improve, which has greatly increased the confidence of companies on the track to actively promote the mass production process. Like Surestar, local companies with independent and complete lidar manufacturing capabilities through self-built production lines have begun to appear one after another.

In addition, with the persistent efforts of a group of domestic LIDAR manufacturers, my country's laser radar industry has achieved fruitful research and development results. Surestar, which has successfully independently developed 24 chips in 5 categories and achieved complete independent control of its core components, is one of the representatives. The C-Fans and R-Fans series of lidars in the navigation product line of Surestar have independent intellectual property rights and have appeared in the test sites and measured road sections of many autonomous driving companies.

The increase in the degree of localization of technology has allowed domestic LiDAR manufacturers to save a large part of the expenditure that will eventually flow overseas, and at the same time more firmly control the pricing power of LiDAR products in the hands of Chinese companies themselves.

In 2017, the Chinese Society of Surveying, Mapping and Geographic Information commissioned Surestar to establish the "Lidar Detection and Scientific Research Achievement Evaluation Center"

China has grown into one of the world’s major lidar markets, and domestic leading companies have the same technological level as overseas. With the further maturity of autonomous driving demand, the long-term revenue space of Chinese lidar companies will be further opened up and stabilized. While having a huge domestic market space, we are facing the global market with the world's outstanding LiDAR manufacturers and fully enjoying the long-term dividends of the autonomous driving era.(www.isurestar.net)