Since the beginning of this year, the news of the lidar industry is more or less closely related to one word, that is, "getting on the car."

In the capital market, from the fourth quarter of last year to the present, seven lidar companies have been listed on the US stock market.

From industry recognition to capital pursuit, lidar has become a must for auto companies to deploy autonomous driving. However, what are the difficulties behind getting on the bus? In which direction is the technological route evolving? Will the future market competition pattern be contending among a hundred schools of thought, or will the strong remain strong? Before judging whether the auspicious time for Lidar boarding has come, you might as well solve the mystery behind it.

01 Who is behind?

In the context of rapid changes in smart cars, the mass production of lidar is directly related to both ends of supply and demand.

On the demand side, the high-level autonomous driving perception technology route is gradually clear: Although the issue of "whether lidar is necessary for autonomous driving" has encountered many disputes, by 2021, after many years of trial operation and data collection, it will be at a high level above L4. On the perception technology of autonomous driving, various players have reached a consensus-Lidar is currently an important auxiliary configuration for L2+ assisted driving, and is a necessary perception configuration for L4 advanced autonomous driving.

"Lidar boarding, in the first dimension, is to improve the ADAS function and break through the L3 autonomous driving bottleneck, but the deeper dimension lies in the data collection based on the lidar system," said Liangdao Intelligent CEO Ju Xueming. As one of the earliest "preachers" of lidar, Ju Xueming has personally experienced the budding and development of the domestic lidar market.

The same is collecting data. The range error of the camera is generally about 10%, and the error of 100 meters is close to 10 meters. Because the data quality error is too large, it is difficult to continue the subsequent algorithm training based on the data. In Ju Xueming's view, because of its ranging accuracy, lidar can collect massive amounts of environmental data after getting on the car on a large scale. These accurate data will have great value for perception training and automatic driving function training. This is why Tesla, such as a car company that insists on not using lidar to participate in the autonomous driving program, still carries lidar on the car during the research and development stage, which is used to collect data to obtain high-quality truth values to train vision algorithms.

On the supply side, the cost of lidar has dropped rapidly to accelerate penetration.

Early mechanical lidar used on Robotaxi, taking Velodyne as an example, 64-line mechanical lidar cost 80,000 U.S. dollars, and 32-line mechanical lidar cost 20,000 U.S. dollars. The first laser radar SCALA that meets the automotive regulations, the price of the first generation also reached the level of 20,000 US dollars. Therefore, customers who currently use SCALA in mass-produced cars, whether it is Audi A8 or Mercedes-Benz S-Class, are all million-class luxury cars, and they have a high price tolerance. Those large numbers of private cars paid by end consumers are obviously much more price-sensitive.

It is understood that in the L4 autonomous driving system, the purchase price of lidar can eventually reach below US$1,000; in the L2+ autonomous driving system, the long-term target price of lidar can reach below US$500.

Part of the lidar supplier price system, organized from the network

After entering 2020, semi-solid and solid-state lidars will gradually replace mechanical radars. The cost and volume of lidars have been drastically reduced, directly from tens of thousands of US dollars to the range of 1,000 US dollars, gradually approaching the price that car companies can accept.

[Surestar] CEO Zhang Zhiwu pointed out that whether the mass production speed of car-grade lidar and the speed of hardware price reduction can be faster than the technological progress of other solutions will become an important guarantee for its future market prospects. As the first domestic lidar company, Surestar launched China's first vehicle-mounted lidar in 2007, which has also witnessed the changes in lidar prices. With the increase in loading capacity and technological improvement, the rapid reduction in installed cost has become another key reason for driving the mass production of lidar. "If the price of a millimeter-wave radar is lowered in the future, car companies will not have to worry about whether to install more lidars."

02 Why is it difficult to get on the car in mass production?

On the road of promoting the advancement of autonomous driving technology, there have been two different path choices: one is represented by Internet companies and adopts a subversive mode to directly enter L4 autonomous driving; the other is represented by OEMs, with Progressively, choose the progressive development route of L1-L5 level.

As the core sensor of high-level autonomous driving perception solutions, lidar technology solutions are mainly used in demonstration scenarios such as Robotaxi and unmanned logistics distribution. Limited by the large-scale landing capabilities of these scenarios, it has been in the small-scale application stage. In recent years, along with the squeeze of traditional car companies by new car manufacturers and Internet companies, OEMs’ demand for intelligent transformation and upgrading of cars has continued to increase. As an important sensing component of autonomous driving, lidar has been affected by more and more OEMs. Favored by the factory, it began to infiltrate vector-produced models.

In addition to the expensive cost of lidar, at the technical level, what is the difficulty in mass production of lidar?

In an interview with Zhihuige, Ju Xueming pointed out: For OEMs, mass production of lidar is a complicated and systematic project, which often takes more than 2 years. In order to ensure mass production under the most controllable time and economic cost, the OEM needs not only the lidar hardware supplier, but also the system solution capabilities for mass production function development, test verification, etc., and the laser needs to be fully considered. Radar suppliers have many factors at the level of mass production capacity, cost, and data iteration verification and upgrade.

Lidar hardware is required: The new generation of Lidar is moving towards solid-state and modular development. While completing hardware development, it must be prepared for hardware testing and international standard certification that must be passed before boarding.

There must be a hardware-based perception algorithm: the perception algorithm here is a mass-production-level algorithm, which must be developed according to different driving environments and road conditions, as well as the requirements of the OEM, and must meet the requirements of functional safety.

To complete the perception test verification: to collect data in the real environment, offline processing to generate true values, and evaluate the performance of the sensor. The key to establishing a data center is to manage and apply massive amounts of data well.

Pay attention to the activation of perception: The current trend in the industry is that the hardware is productized with the car first, and the software OTA upgrades iteratively. Therefore, after the lidar hardware gets on the vehicle, it relies on the returned data to do algorithm training, function iteration, and software upgrades, and finally form a big data closed loop.

Solve these problems, and then the lidar can be actually used and can be mass-produced.

03 There is no standard answer to the technical route

Discussions on technical routes are another focus topic in the lidar industry.

Lidar uses laser light emitted and reflected back from obstacles to detect obstacles. In this process, different core technologies such as light wave emission, beam operation, detection, ranging, and data processing methods will result in lidars with different performance and effects.

In the current photoelectric system, the mirror-like structure of the scanning component diverges the laser beam into more light, which is also the largest cost unit in the lidar, which directly affects the performance. The mechanical, semi-solid, and solid-state we often say are classified according to the movement of the scanning module and the laser transceiver module.

Comparison of advantages and disadvantages of different types of laser mines, sorted out from the network

Mechanical is currently the most technologically mature route, and it is also an earlier scheme adopted by autonomous driving companies. A mechanical lidar that obtains a 360° field of view by rotating the laser emitting and receiving module has the characteristics of fast scanning speed and strong anti-light interference ability. However, in the actual landing process, mechanical lidar has faced a series of obstacles for a long time.

Surestar-CEO Zhang Zhiwu told Zhihui brother that the first thing to bear is the cost. The price is too high for car companies and consumers to afford; and limited by the service life of mechanical parts, the reliability and stability of mechanical lidar are also inexhaustible. In addition, the large size, difficult to pass the car regulations, complicated technology, and low production efficiency are all bottlenecks for the mass production of mechanical lidar.

Most of the currently released models have chosen semi-solid lidar. The Livos lidar of Xiaopeng P5 belongs to the prism solution, while the Innovusion of Weilai ET7 and the lidar of Alpha S Huawei HI version belong to the rotating mirror solution. Auto companies mainly adopt semi-solid for the following reasons:

Compared with mechanical lidar, semi-solid is easier to reduce costs, and compared with pure solid (OPA, Flash), the technology is relatively mature, and it is easier to achieve commercialization;

The rotating mirror solution is the first technical solution that has passed car regulations, has a controllable cost, can meet the performance requirements of car companies, and realizes batch supply;

The prism scheme has a larger number of laser transmitters, which can also achieve higher point cloud density and longer detection distances.

Among the models that have been released with lidar, the routes chosen by different brands are also different:

Of course, there are other ways. Great Wall Mocha directly chose the Flash solid-state lidar provided by Ibeo. There are reasons for cost and size, as well as consideration of performance requirements. Different products are based on different scenarios, and there are often different hardware product choices.

Which technical route the lidar hardware supplier chooses is mainly based on the judgment of technological development and the understanding of the product. From the perspective of hardware combing, each technical route has advantages and disadvantages, but there is a relatively definite trend, which is to truly supply OEMs with high cost performance, reliable reliability and price advantages. "As for whether the scanning method is flash or rotating mirror or prism, these are actually not important, as long as it can meet the car regulations to solve the product performance and cost issues, it will do," Zhang Zhiwu said.

04 A hundred schools of thought contend or the strong are always strong

It is not difficult to see that on the road to mass production of lidar, car companies need more than just available lidar hardware. At the technical level, the detection performance including solid-state lidar and the corresponding chips, software, and algorithms need to be strengthened. More importantly, in addition to the level of technological innovation, mass-produced models must comprehensively consider stability and safety. Therefore, technical standards and specifications also need to be put on the agenda. At the end of 2020, the first domestic vehicle lidar standard "Vehicle Lidar Detection Method" will be approved. The development and speed of this work will have an important impact on the technological development and market application of lidar.

Will the lidar market in the future continue to contend with a hundred schools of thought?

In Ju Xueming's view, this also depends on the different requirements of the application scenarios of the lidar; in the same car, products with different performances will also be selected due to different deployment positions; in the field of smart transportation, you can also use Lidar is installed at the end of the road to provide perception from God's perspective. Therefore, there is a lot of market space and opportunities. Secondly, from a product perspective, the development of lidar is still on the rise, and the emergence of new technologies is not ruled out. "So overall, for a long period of time in the future, Lidar competition will still be a state of contention among a hundred schools of thought."

"This track is hard power, relying on product power and cost power to drive two wheels, in the end will only make the strong always strong", Zhang Zhiwu also gave his own answer. "If the performance does not meet the demand, it is impossible to win in the lidar track. Many lidars on the market may have strong performance in one aspect, such as strong ranging ability or high resolution, but the real-time update frequency is not enough, or Insufficient stability and reliability, and inability to get on the car, this has caused it to not be promoted in large specifications. Some companies use very expensive components, or his process cannot achieve mass production, and cannot win. Eventually a group of companies will be marketed. disuse."

The mass production of lidar vehicles cannot be achieved by a single company alone. Collaborative innovation in the industrial chain, supply chain, and technology is required, and more manufacturers are required to run toward the goal of mass production of vehicles.

Some people call 2021 the first year of mass production of lidar. From the perspective of the number and scale of products, lidar has indeed ushered in a period of considerable outbreak. However, it should be noted that the hardware is easier to get on the car than the original traditional parts, and the function is from getting on the car to mature, and there are many system-related tasks from hard to soft. We will see more lidars on more models next year. Are their functions complete? Is security reliable? Is the price reasonable? Everything remains to be tested.

Before that, Lidar had a long and tortuous road.

In other words, the mass production of lidar vehicles cannot be achieved by a single company alone. Collaborative innovation in the industrial chain, supply chain, and technology is required, and more manufacturers are required to run toward the goal of mass production of vehicles. Already on the way.

05 Surestar is on the way

Since launching the intelligent networked car business, Surestar has taken the development of pre-installed and mass-produced solid-state lidar as its core goal. After comprehensively reviewing various technical routes, it is considered that the mass production of mechanical lidar is difficult, and OPA is difficult to get out of the experiment. In the laboratory, fiber lasers are more suitable for surveying and mapping laser radars. Dr. Zhang Zhiwu, CEO of Surestar, said: “We can save a lot of research and development time by not touching on technical paths that have obvious theoretical flaws, performance ceilings, and cost bottlenecks.”

The Surestar car-gauge lidar aimed at the following goals at the beginning of the design: one is cheap; the other is small and exquisite; the third is low power consumption; the fourth is strong environmental adaptability; the fifth is high reliability; the sixth is suitable for mass production .

Starting from the goal, combined with the requirements of car regulations, cost, scenes, etc., Surestar finally chose the path of micro galvanometer. With years of exploration and accumulation in the field of lidar, Surestar released the first product of the self-developed micro-rotating mirror lidar C-Fans series in 2017.

The micro-rotating mirror architecture of the C-Fans series of products is "unique". It is the first to miniaturize and solidify the laser transmitting and receiving module and signal processing module of the lidar. It uses a micro-motor to drive the polygon mirror to scan, giving full play to the advantages of the micro-rotating mirror technology route. On the basis of this, a low-cost front-mounted solid-state lidar based on semiconductor technology has been created.

This stems from Surestar's repeated challenges in optical-mechanical structure, laser transmission and reception, signal processing, manufacturing technology, chip, light and small size, etc., making it a large field of view, long measuring range, high resolution, low-cost car-gauge lidar Become reality.

C-Fans-256

Not long ago, Surestar officially released the image-level ultra-high-resolution solid-state lidar C-Fans-256, which is not only excellent performance, high reliability, low power consumption, but also a car-level lidar product that is no longer expensive. .

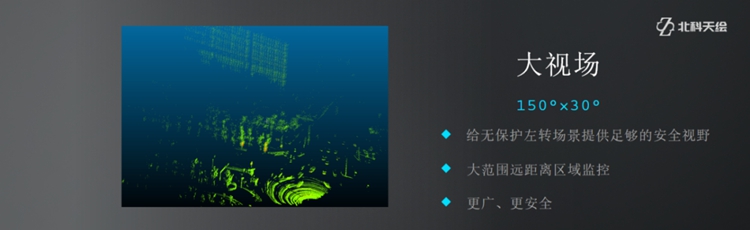

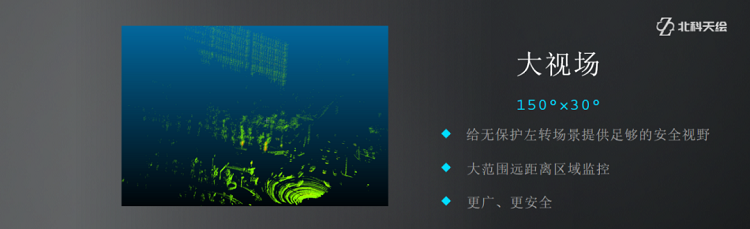

C-Fans-256 has a resolution of 0.1°x0.1°, which can accurately capture vehicles and pedestrians at a distance of 200m. With its omni-directional scanning field of view, it can easily achieve large-scale and long-distance area monitoring. It provides a wide field of vision in difficult scenes such as unprotected left turns, etc., so as to take care of vehicles or pedestrians on the right.

The ultra-high frame rate of the sports camera level enables C-Fans-256 to have a powerful field of view and abnormal event capture capabilities, whether it is detecting obstacles, or in ghost probes, high-speed merging into the main road, high-speed sudden braking and other automatic driving It has excellent performance in difficult scenes, and is more suitable for high-speed, dynamic, and complex real driving environments. At the same time, C-Fans-256 realizes clear all-weather lane line recognition by virtue of its 8bit grayscale resolution, which significantly improves the all-weather perception ability of the unmanned driving system.

At present, the C-Fans series products have passed IATF 16949 (Quality Management Certification System for the Automobile Industry), and have completed a series of car gauge reliability tests under the ISO 16750 standard. Among them, C-Fans32 is currently the only lidar product that has passed “intrinsically safe” certification; C-Fans-256 achieves low power consumption of less than 16W and has passed ISO 16750, a total of 9 categories and a total of 31 tests. sex. The achievements of these two products have verified the contribution of Surestar's autonomous chips in terms of low power consumption, low starting current, and low heat production, ensuring the safe operation of robots and unmanned vehicles in flammable and explosive environments such as coal mines. sex.

The performance and cost advantages of C-Fans lidar are derived from Surestar's core technical strength. Up to now, Surestar has successfully realized the chipization of the laser radar signal processing core module, and has independently developed 24 chips in 5 categories, achieving complete independent control of the core components.(www.isurestar.net)